Bring More Data

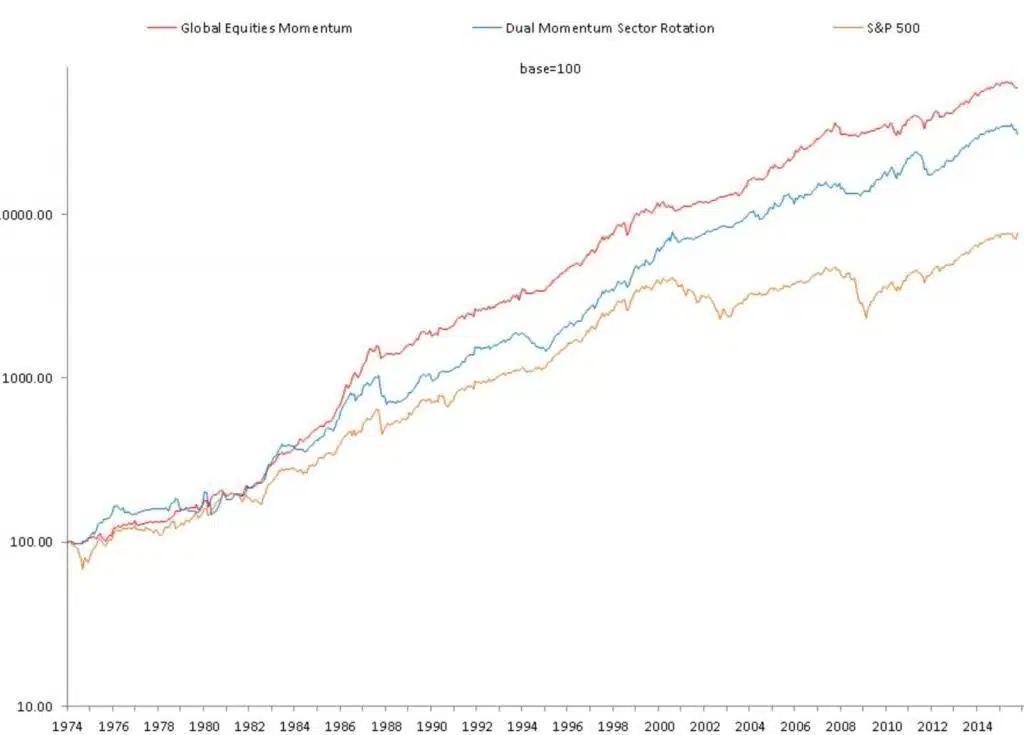

Several months ago we posted an article called “Bring Data” where we showed the importance of having abundant data for system development and validation. This was further reinforced to us recently when someone brought us additional U.S. stock sector data. Previously, we only had Morningstar sector data that went back to 1992, which we used to construct […]

Dual Momentum for non-US Investors

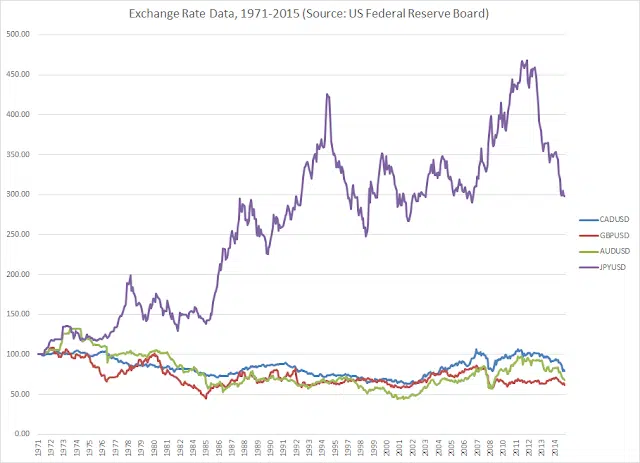

Gogi Grewal CFA is an analyst who has been following my work for years. He has an excellent grasp of dual momentum. Since Gogi lives in Canada, he researched the best ways for non-US investors to use momentum. Gogi has generously offered to share his findings with us here. I would add that if there […]

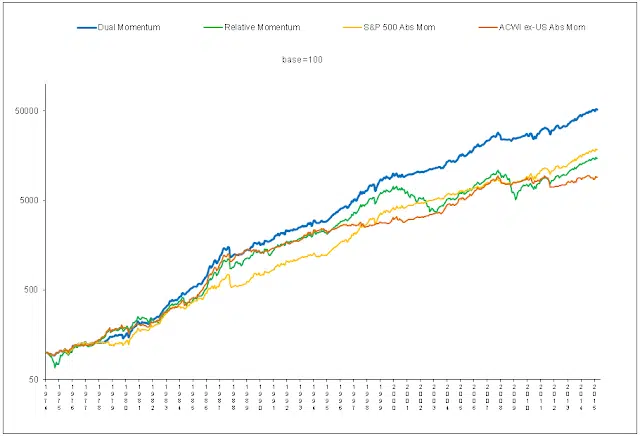

Dual, Relative & Absolute Momentum

Years ago when I first started studying momentum, two things stood out to me. The first was that most momentum research focused on cross-sectional stock studies. These looked at the future performance of stocks that had been strong versus stocks that had been weak. This was what interested academics most, since abnormal profit from strong […]