Is Modern Investing Still in the Dark Ages?

I began my investment career in 1974 when investing was still in the dark ages. There was no online trading. All orders were placed by

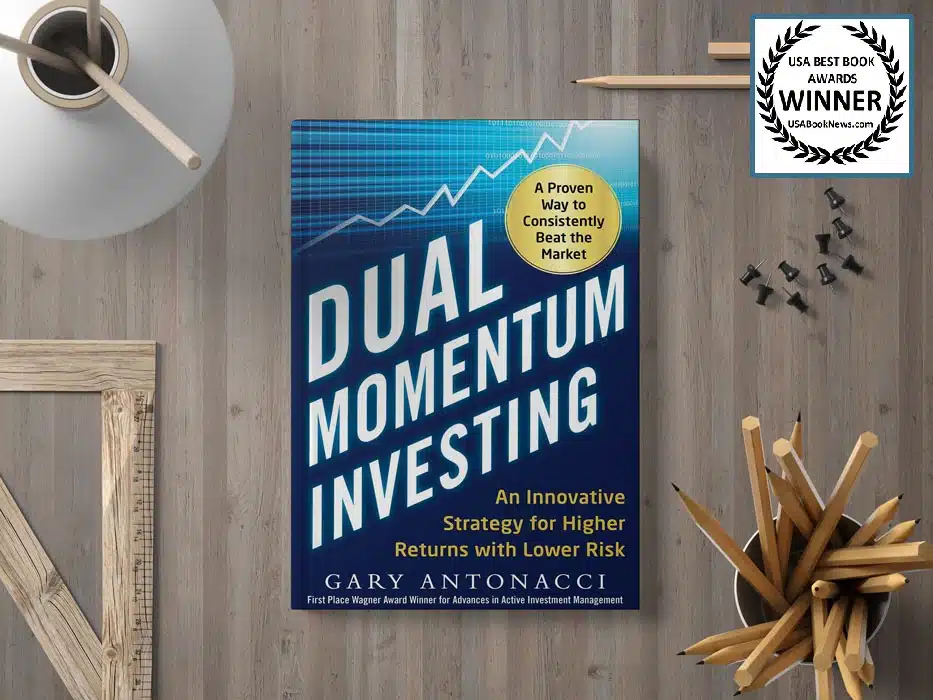

Presenting research and applications of dual momentum investing as discovered

by its founder Gary Antonacci, author of the book Dual Momentum Investing

Gary Antonacci, founder of Optimal Momentum, has over 50 years of experience as an investment professional focusing on underexploited investment opportunities.

After receiving his MBA from Harvard Business School, Gary concentrated on developing innovative investment strategies based on academic research.

His research on momentum investing was the first-place winner in 2012 and the second-place winner in 2011 of the Founders Award for Advances in Active Investment Management given annually by the National Association of Active Investment Managers (NAAIM).

Gary introduced the world to dual momentum, combining relative strength price momentum with trend-following absolute momentum. He now focuses on constructing diverse multi-model portfolios utilizing different measures of trend, relative strength, mean reversion, and other anomalies.

Momentum is based on the Newtonian notion that a body in motion tends to stay in motion. The classical economist David Ricardo translated momentum into investment terms with the oft quoted phrase, “Cut your losses; let your profits run on.”

Momentum dominated the 1923 book, Reminiscences of a Stock Operator, about the legendary trader Jesse Livermore. Momentum-based velocity ratings were used in the 1920s by HM Gartley and published in 1932 by Robert Rhea. George Seaman and Richard Wyckoff also wrote books in the 1930s that drew upon momentum principles.

I began my investment career in 1974 when investing was still in the dark ages. There was no online trading. All orders were placed by

Even with top performing mutual funds, investors can be their own worst enemies and find ways to underperform. Fidelity’s Magellan had an average annual return

The most common way people invest is with strategic asset allocations to stocks and bonds, with perhaps a small allocation to alternatives. This approach passes