My last article, “The Trend Is Your Best Friend – Here Is Why”, showed how investors can benefit from applying trend following to all investment assets. This article will explain the best ways to do that.

A common but flawed approach is to add a modest amount of trend following to one’s portfolio using managed futures. These are available through managed accounts, mutual funds, or ETFs.

But managed futures provide sporadic returns. They did well in 2022, but the Morningstar managed futures fund category only gained 2.5% over the past ten years. It was down 0.5% over the past fifteen years. Only one managed futures mutual fund or ETF with at least a 10-year track record has an average annual return above 4%.

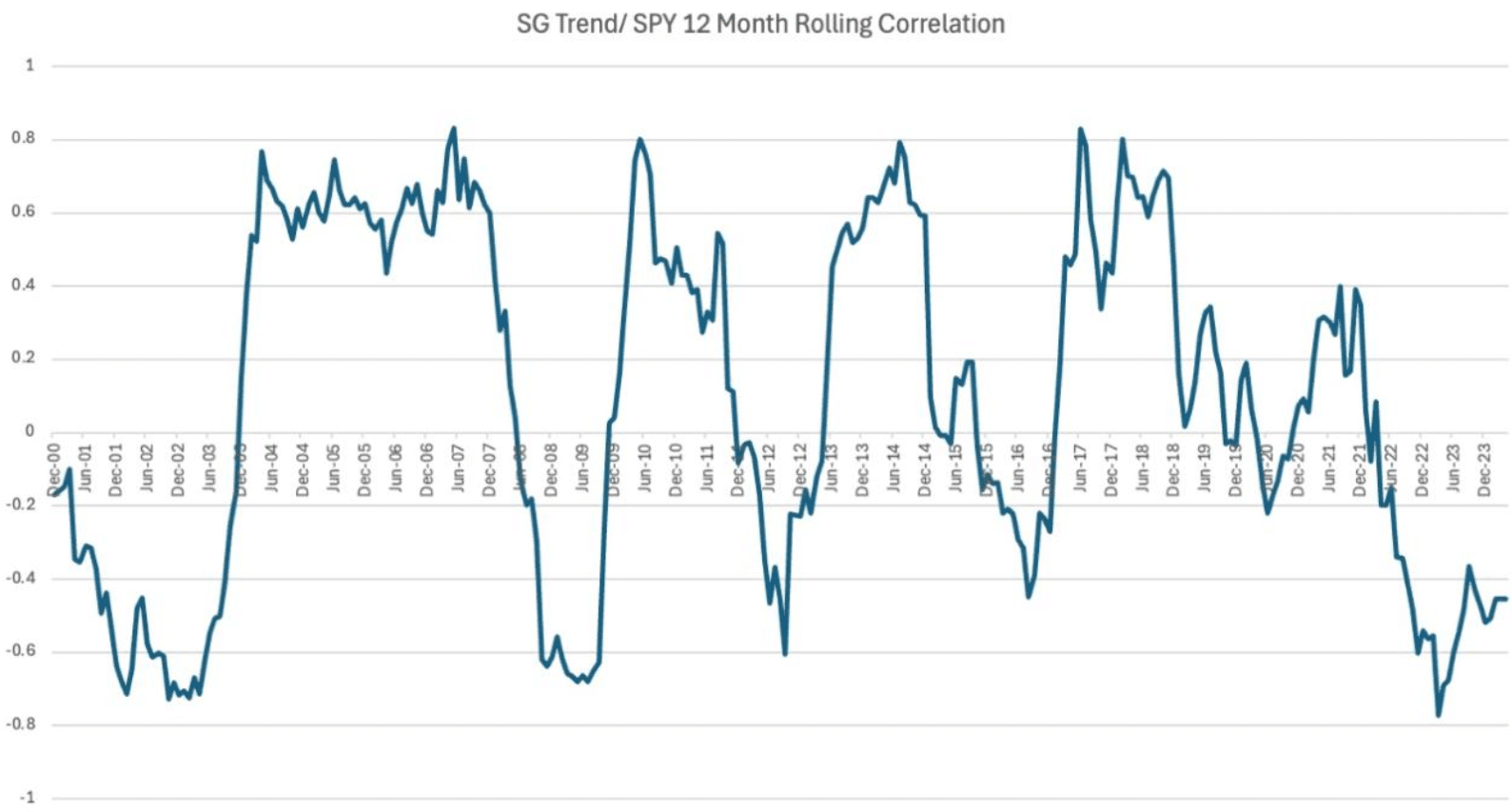

There is the same issue with managed futures as with bonds for portfolio diversification. They do not always provide diversification and can drag down portfolio returns. Like bonds, managed futures spend as much time being correlated with the stock market as they are being uncorrelated. Here is the rolling correlation of the SG Trend Index of the largest commodity trading advisors versus the S&P 500 (SPY).

We use managed futures and commodities in one of our proprietary models. However, we only hold them when they are attractive based on trend and relative strength. That happened in 2022, but not since then. Managed futures may have portfolios that are too broad, leading to mediocre returns. Not all markets respond well to every trend-following approach. Most advisors use a single trading approach. However, it is better to use multiple trading methods.

Other Problems

Another way some people use trend-following is with public models monitored on several websites. A big problem is that most of these models also overfit a limited amount of data. It’s not difficult to find something that looks good by torturing the data.

As I point out in my book, markets usually have regime shifts every 15-20 years. If you build a model based on fitting data over the past 20 years, you are likely in for an unpleasant surprise when you apply the model to future data.

The researcher Ken French said stock market trading methods need at least 75 years of data to be statistically significant. I don’t know anyone who has been trading that long. (If he were a trader, Keith Richards might qualify.) What can we do about this?

Solutions

Rate of change, aka time series or absolute momentum (including moving averages), and channel breakouts are the two most common trend-following methods. As I pointed out in my last article, I am co-author of a research study showing that channel breakouts of stock industries provide twice the return of buy-and-hope while reducing drawdowns by 60% over the past 100 years.

In their book, Greyserman and Kaminsky show that rate of change increased returns and lowered drawdowns from the beginnings of many major markets. That would be the 1600s for stocks, the 1300s for bonds, and the 1200s for commodities. You can see that by clicking “Read Sample” on the book’s Amazon page.

Your chances of success are higher if your trading approach is simple and follows the logic of these two proven strategies. As an investor, this is one of the things you consider when evaluating a trend-following investment.

There are also “reality checks” that reduce the chance of data overfitting. Here is a way to do that. Here is another way to reduce overfitting.

Other Things to Consider

Potential investors should also look for robustness in their trading systems. Does the same approach work well in many different markets? Has performance been consistent over time? Is the approach logical and in agreement with what we know about the markets?

What Not to Do

A common mistake made by those who don’t know any better is to judge an investment by its real-time performance over the past few years. Past performance over five or ten years is almost as worthless as investing based on overfitted backtests on limited data. It’s not only investors who are guilty of this. Institutional money managers and investment advisors also make this mistake. A study of pension consultants showed they made their recommendations based largely on the last 3 to 5 years of real-time performance. Clients would have been better off ignoring these recommendations.

Decent performance could be due to luck in the short run, especially in a bull market. I would rather judge investment potential based on a proper backtest using copious data, which is often not hard to do. We run all our stock market models on S&P 500 index data going back to 1962 and data on other markets. We also want our models to conform to academic research findings over at least 100 years and hold up under robustness testing. That is how you can have confidence in your approach.

Confirmation Bias

Another common mistake is when investors fail to recognize the transformative nature of trend following. Few hold gold in their portfolios, and for good reason. It has underperformed traditional assets over many decades. Gold is usually held in small amounts by those who fear global catastrophic events like nuclear war or Taylor Swift’s retirement.

But we have the Gold Long Trend (GLTR) model that earned more than twice what the S&P 500 has since 1999 when we started to have reliable daily gold data. GLTR’s worst drawdown was only ¼ of the S&P 500’s. GLTR is up 36% so far this year. Yet less than one-third of the accounts managed by the advisor who uses my proprietary models the most have GLTR in their portfolios.

The same is true of digital assets. Over 95% of surveyed financial advisors recommend or plan to recommend crypto to their clients, but the average allocation is only 2%. Our Bitcoin and Digital Asset Synergistic System (BADASS) is another channel breakout model that holds equal amounts of blockchain technology and Bitcoin ETFs when their trends are positive.

Since 2018, BADASS has had over 4 times the return with lower drawdowns than the S&P 500. BADASS is up 98% so far this year. Yet less than one-third of that advisor’s investors have BADASS in their portfolios.

Investors should examine the long-term trend-following research results until they understand their risk-reducing characteristics. Then, they may be able to clearly see the difference between assets with and without trend-following.

Portfolios

Many investors underestimate the importance of proper portfolio structuring. They look at assets or trading approaches in isolation. This can cause them to make poor decisions. Trend-following investors need to appreciate the role of portfolio structuring using approaches with low or moderate correlations to reduce volatility while providing attractive returns.

Even if GLTR were not an exceptional model (which it is), it could still add portfolio value because it has a low correlation to our other models. Thoughtful diversification is the closest thing to a free lunch in investing. Diversifying with different trend-following systems and multiple assets elevates portfolio performance to a higher level. It further reduces the volatility from models using aggressive assets. By reducing your downside exposure, trend following lets you favor higher-volatility assets and earn higher returns.

The Times Are A Changing

This should not prevent you from incorporating new ideas. Academics once regarded trend-following as imaginary, like astrology or bipartisanship. However, it has attracted more academic attention in recent years based on its documented success. Some studies now show ways to improve trend following, such as here, here, and here. However, the core principles remain unchanged.

Past performance is no assurance of future success. Please see our Proprietary Models and Disclaimer pages for more information.