I have never been a big fan of the bond market. From 1900 through 2022, the annualized real return of long-term U.S. government bonds was 1.7%, while the return of U.S. stocks was 6.4% [1]. Having bonds as a large part of one’s portfolio would have created a substantial drag on long-term performance and substantially less terminal wealth. It is not surprising that Warren Buffett instructed his heirs to put 90% of their inheritance into an S&P 500 index fund and 10% into U.S. Treasury Bills.

Bonds have been popular for several reasons. Even though the expected return of bonds is much lower than the expected return of stocks, investors perceive bonds to be much less volatile. But this has not always been the case.

Bond Risk

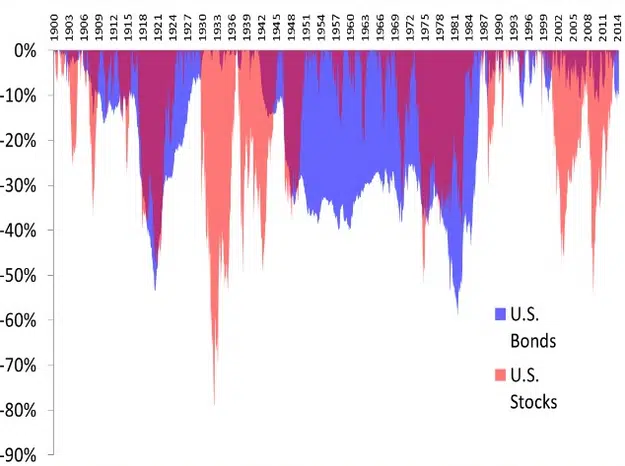

Since 1900, the maximum drawdown in real terms of long-term U.S. government bonds has been 68%. The maximum drawdown of U.S. stocks was only a little larger at 73%.

For every five-year period since 1807, the worst performance of stocks was only slightly worse than the worst five-year performance for bonds. When looking at 10-year holding periods, the worst stock market performance was better than the worst bond market performance! [2]

Bond Correlation

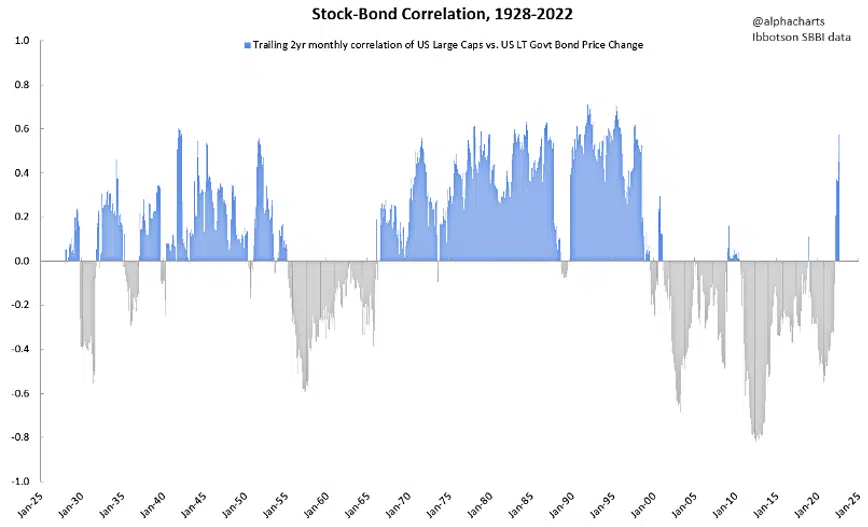

Bonds are also thought to be a good diversifier because of their low correlation to stocks. But that is also not always the case. Ask anyone who held both stocks and bonds in 2022 when both were down.

Since 1875, the monthly correlation between U.S. stocks and intermediate U.S. bonds has been positive more than it has been negative [3].

Even during periods of negative correlation, bonds may fail to offer the protection investors expect if there is market stress. At these times, investors may exit all risky assets in their flight to safety. The only thing going up in such periods is correlation. Diversification can fail when it is needed the most.

A Different Way to Use Bonds

With this evidence casting doubts about the utility of bonds, you may be wondering how bonds can outperform stocks over the long run. The following should make this clear.

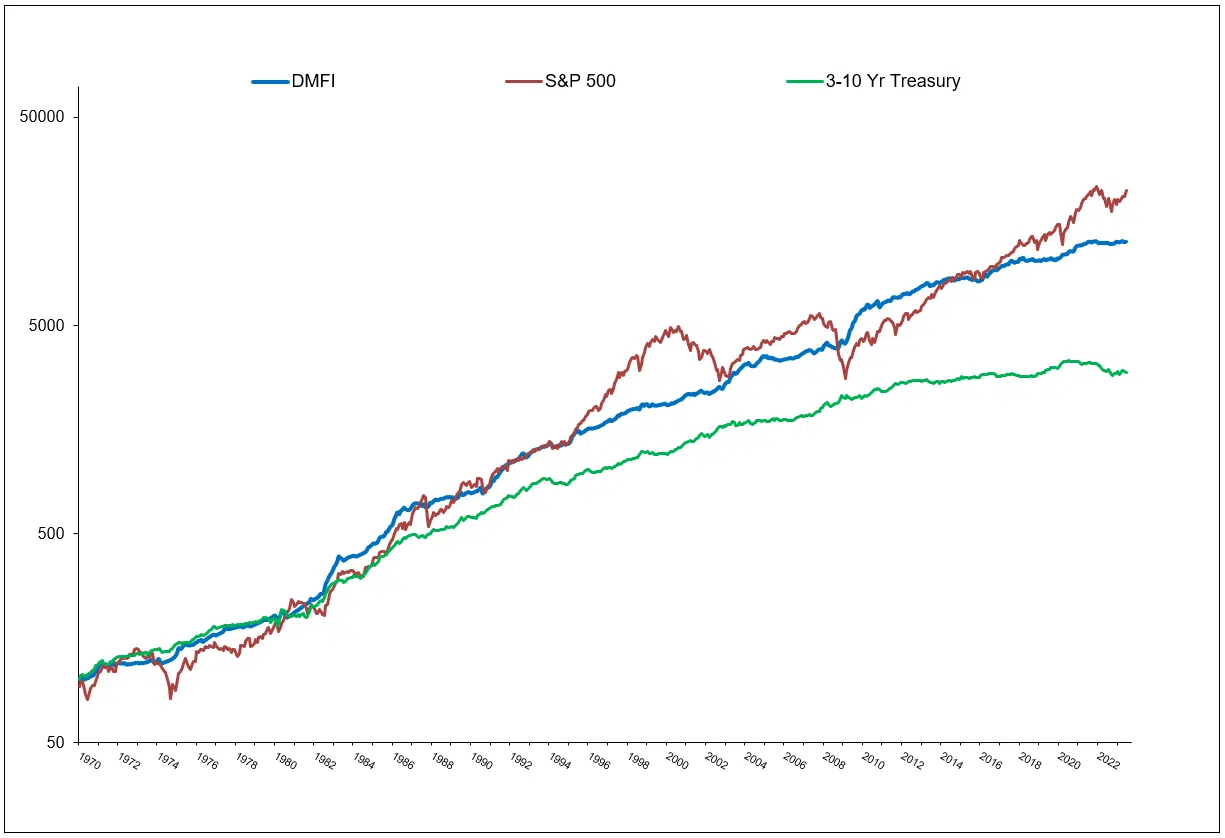

Here is the performance of two investable approaches from January 1970 through June 2023. Which one do you think is more attractive? Which would you rather have had as an investment?

A | B | |

CAGR | 9.4 | 10.6 |

Standard Deviation | 5.6 | 15.4 |

Sharpe Ratio | 0.84 | 0.44 |

Ulcer Index | 1.61 | 12.86 |

Worst Drawdown | -6.3 | -51.0 |

Avg Drawdown | -0.9 | -7.6 |

% Up Months | 76 | 63 |

Results are hypothetical, not an indicator of future results, and do NOT represent returns that any investor attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Drawdowns are on a cumulative month-end basis. Ulcer Index measures the depth and duration of drawdowns from earlier highs. See our Disclaimer page for more information.

Approach B is the S&P 500, the world’s largest equity index. According to S&P Dow Jones, this index had $7.1 trillion invested in it as of 12/31/2021. It is the most popular of all investable indices.

Approach A is my Dual Momentum Fixed Income (DMFI) model that rotates among short and intermediate-term sectors of the bond market. DMFI is our simplest proprietary model. It uses only relative strength and trend as described in my book.

Some may wonder if DMFI’s attractive returns were due to a strong bond market since 1970. Sixty percent of the time bonds were strong. But they were not strong the other 40% of the time. The long-duration end of the bond market benefited most from the strong bond market. But DMFI uses only short to intermediate-term bond indices. DMFI’s excellent performance was mostly due to loss minimization through trend following and increased profits from bond sector rotation.

Results are hypothetical, not an indicator of future results, and do NOT represent returns that any investor attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. See our Disclaimer page for more information.

No Respect

DMFI is the Rodney Dangerfield of investments. There are more than a dozen stock-oriented momentum funds, but zero bond momentum funds.

My research papers and book with do-it-yourself instructions point out that bond momentum has worked well. Information about my DMFI model has been available to investors for nearly ten years. Yet it has attracted little investor interest until recently.

DMFI has the best reward-to-risk ratio of all our models. If I had to pick only one model to use, it would be DMFI. But we can combine DMFI with other models as a low-volatility diversifier. DMFI is, in fact, the perfect vehicle for a “barbell approach” combining lower and higher risk approaches having modest correlation. See the Proprietary Models page of our website for more on this.

Bond dual momentum deserves to be a core holding. Why has this not happened?

Why Bond Momentum Has Been Neglected

Behavioral anomalies explain momentum. Underreaction to new information is one of these anomalies. My research papers compared momentum applied to different markets. Momentum beat buy and hold in everything I tested. However, it worked best when used with geographically diversified stock indices.

Geczy & Samonov (2017) showed similar results back to the year 1801. Momentum applied to bonds, commodities, sectors, stocks, and stock indices all beat buy and hold. However, geographically diversified stock indices performed best.

Yet most momentum investing is applied to individual stocks. This may be because academics have focused on cross-sectional stock returns. Doing so makes sense when you are looking to accept or reject challenges to the efficient market theory. So, most momentum research has focused on comparing ranked sections of stocks. Bond momentum has suffered from the lack of information about other ways to use momentum.

Familiarity Bias

In my marketing class at the Harvard Business School, we had a case where Smuckers introduced gourmet ketchup. We were supposed to figure out why they failed miserably with this. After looking at many possible reasons, we concluded it was because the public had trouble accepting ketchup from a company known for its jams and jellies. Smucker’s failure was due to familiarity bias and public expectations.

Similarly, investors have had trouble accepting a bond-based approach as a primary portfolio holding. That is not what they expect from bonds. Biased preconceptions lead most investors to the stock market as their primary investment vehicle. Those who can think outside the box and overcome their long-standing biases may be amply rewarded for doing so.

The psychological aspect of investing is what makes the markets interesting. They can also be exceptionally rewarding if one is open to new ideas and unbiased. Sir John Templeton once said, “If you want to have better performance than the crowd, you must do things differently than the crowd.”

Contact us for fact sheets on DMFI and our other dual momentum models.

[1] Siegel, 2023, Stocks for the Long Run: The Definitive Guide to Financial Market Returns & Long Term Investment Strategies, McGraw Hill, 2023

[2] Dimson, et al., 2023, Credit Suisse Global Investment Returns Yearbook 2023

[3] Molenaar, et al, 2023, Empirical Evidence on the Stock Bond Correlation