Last year when bitcoin had its fourth drawdown of 80% in the past ten years, I thought It might be a good time to reenter that market.

Having traded digital assets in 2017 and 2018, I was familiar with the reasons for owning bitcoin. I won’t reiterate them here. You can find information on bitcoin, blockchain, and decentralized finance (DeFi) here, here, and here.

Every disruptive technology, like electricity or the automobile, has its skeptics and detractors. There may be some legitimate issues to consider like those here and here.

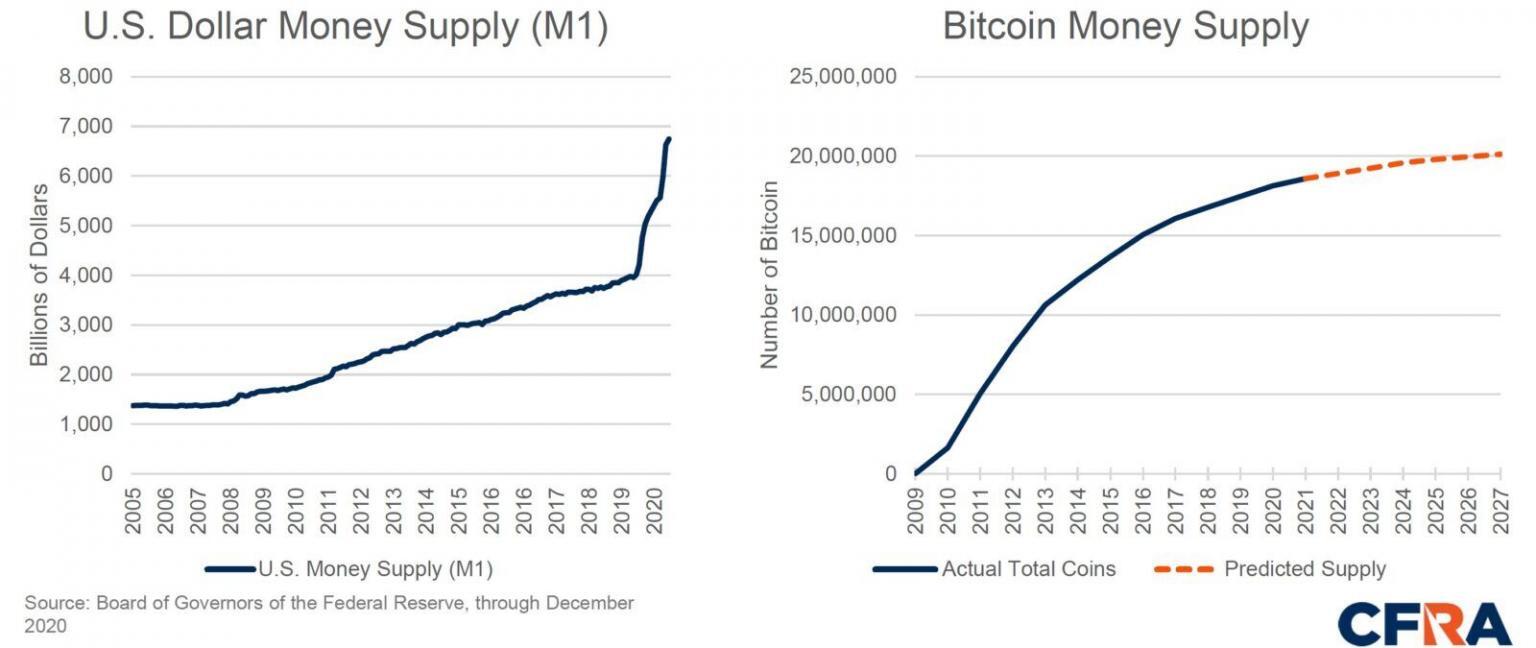

Supply and Demand

What seemed most cogent to me at the time was supply and demand. The world money supply was increasing quickly to stimulate world economies reeling under the pandemic. Limited quantity assets, like gold, real estate, and bitcoin, should appreciate to stay in equilibrium.

There will never be more than 21 million bitcoin, of which 89% have already been mined. That leaves a circulating supply of 18.5 million bitcoin. About 3 million have been lost. Much of the rest is illiquid and held by HODLers. Glassnode estimates that 78% of the circulating bitcoin last December was illiquid. Only 4.2 million bitcoin were available for buying and selling. Liquidity goes up when the price of bitcoin goes down, but there is still less tradeable supply than many realize.

On the demand side, there has been increasing institutional and public interest in digital assets. Investors can now trade bitcoin using popular apps by Robinhood, PayPal, and Square. An increasing number of banks and brokers have set up digital asset trading desks. Involvement by hedge funds and other institutional investors has been growing.

Rick Rieder, CIO of BlackRock, the world’s largest asset manager, said bitcoin is more functional than gold. He also said BlackRock has “started to dabble in it.” Ray Dalio, head of Bridgewater Associates, the world’s largest hedge fund, also has some bitcoin. So does billionaire investor Stanley Druckenmiller. Prominent personalities, like Paul Tudor Jones, Mark Cuban, and Elon Musk, have become bitcoin enthusiasts. Late last year 169-year-old Mass Mutual made a $100 million bitcoin investment. This followed bitcoin purchases of $440 million by MicroStrategy and $1.5 billion by Tesla.

So, I put a modest amount into bitcoin last year intending to HODL it long-term. I had no idea bitcoin would go up tenfold within a year. Based on my past experience with crypto assets, I took out my original investment and some profits earlier this year. But what to do with the rest? I decided to look more closely at the pros and cons of bitcoin.

Traditional View

Bitcoin proponents call digital assets a financial revolution that can transform the world’s monetary system. They see bitcoin as the equivalent of a reserve currency and a bastion of free-market enterprise. They accuse economists and politicians of looking in the rearview mirror and thinking “Everything that can be invented has been invented.” A knowledgeable bitcoin proponent I know equates economists to Ken Olsen, founder of Digital Equipment Corporation, who once said, “There is no reason for any individual to have a computer in his home.”

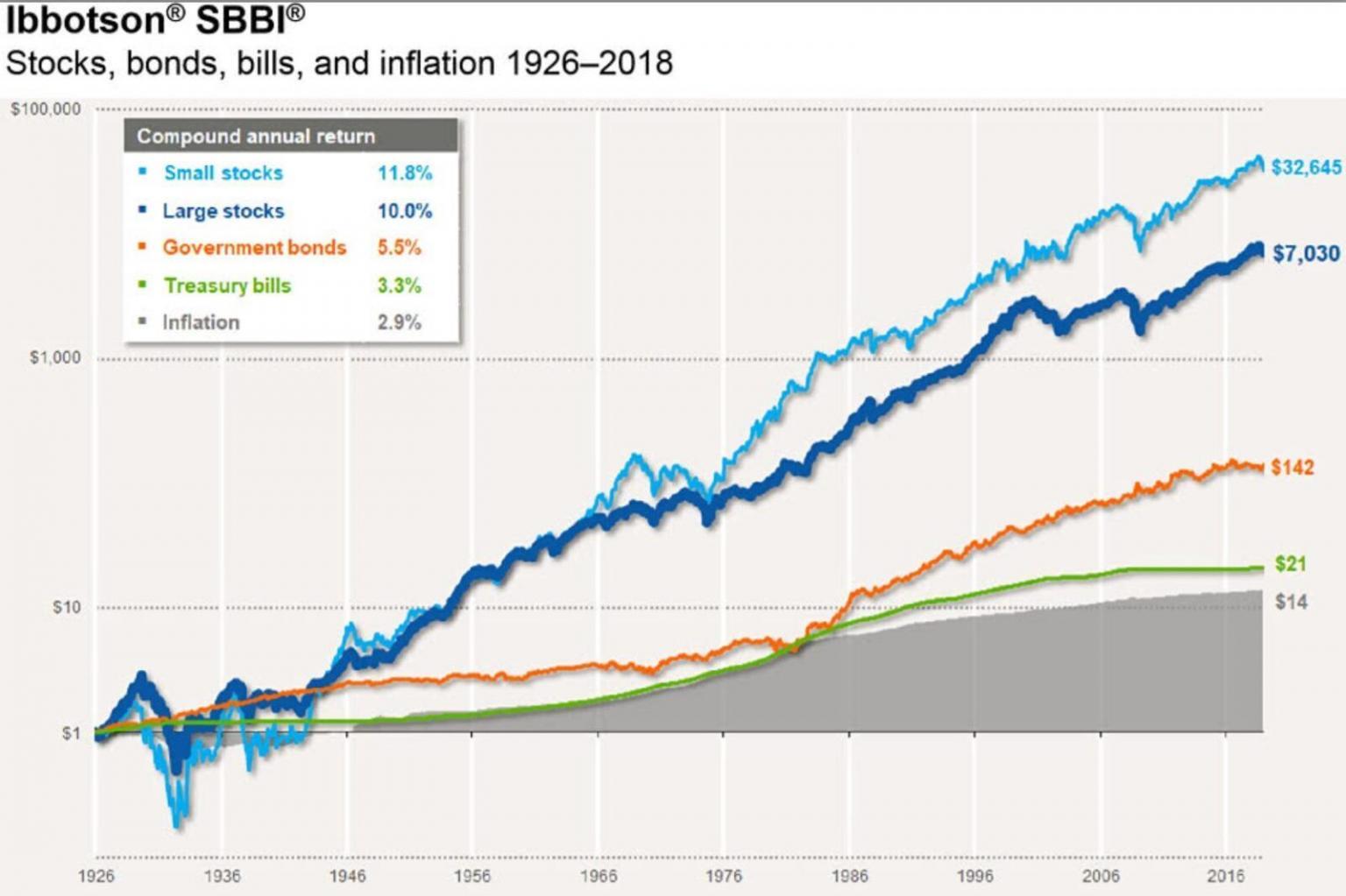

On the other side, some well-known critics of bitcoin call it “rat poison” or a “cult.” A more reasoned argument is that most assets automatically adjust to the monetary inflation that alarms bitcoin enthusiasts. Stocks, bonds, and Treasury bills have all stayed ahead of inflation.

Economic data shows that incomes also increase in line with inflation through higher wages and cost-of-living adjustments.

Economists say if crypto-assets become predominant as desired by bitcoin proponents, we would return to the ups and downs of pre-monetary policy. Governments could lose their ability to fight recessions and reduce unemployment. Business cycles would be more volatile, as they were in the 19th Century and during the Great Depression.

Top Economist Views

Digital assets and blockchain technology represent revolutionary financial innovations. They should therefore be interesting to most economists. Here is what Nobel laureates in economic science say about bitcoin and blockchain technology.

Robert Engle believes digital assets are here to stay. Engle says cash is not going to be the ultimate medium of exchange. Engle thinks central banks should manage digital currencies.

Paul Romer is positive about blockchain technology. He says the theory behind bitcoin is that people do not trust the government to backstop a currency, He thinks the idea that the government cannot handle it or do it right is overstated. Romer predicts that in 100 years there will be at least a second alternative to the dollar and the FED as the clearinghouse for the world. But he says those alternatives are still up for grabs.

Paul Milgrom is a consultant to Algorand, a next-generation blockchain platform. He is more knowledgeable about blockchain than most other economists. Milgrom acknowledges the unique attributes of bitcoin. He says it is easy to transact, the government cannot confiscate it, and it is a hedge against monetary inflation.

Milgrom says bitcoin is valuable because other people say it is valuable. It does not have any inherent value of its own. Milgrom thinks fear of missing out is what drives it. Bitcoin is demand feeding on itself. Milgrom believes there will be lower-cost substitutes at some point.

Bengt Holstrom, like most economists, is bullish on blockchain technology. He says it solves the trust issue and has the potential to revolutionize the way financial institutions operate. But Holstrom is skeptical of bitcoin. He does not think it will replace fiat currencies because the Identity authentication process of bitcoin requires a lot of resources.

Richard Thaler says bitcoin looks like a bubble, but bubbles can sometimes keep going up. He does not know why anyone engaged in legal activities would want to use something as volatile as bitcoin.

Robert Shiller calls bitcoin an impressive technology. He says digital assets have no value unless there is some common consensus that they do. Shiller thinks gold would at least have some value if people did not see it as an investment. He says it is likely that bitcoin will collapse and be forgotten. Shiller added that bitcoin is a psychological market and could linger on for a long time.

Eric Maskin received the Nobel prize for work in mechanism design. So, he is particularly interested in blockchain. Maskin thinks that because the technology protects you, blockchain makes it possible to trade with many more people and to greatly expand world output. He thinks all money will be electronic twenty years from now.

Like many other economists, Maskin is skeptical of private digital assets. His reservations about bitcoin are mostly due to its price volatility. Maskin said, “Except for the fact that Bitcoin fluctuates wildly and therefore is attractive to a certain kind of speculator, it’s hard for me to see why anyone would want a private cryptocurrency when they can do the same thing with government-backed digital currency.”

Maskin acknowledges that blockchain can make transfers easy, cheap, secure, and quick. But he thinks that is also true of central bank digital currency (CBDC). Maskin believes government-backed digital currency will offer greater acceptance and liquidity than bitcoin. He thinks CBDC will drive out private digital assets.

Christopher Pissarides likes blockchain because of its transaction speed and decentralized nature. He says bitcoin is not a currency. It is used more for speculation than for transactions. Pissarides thinks bitcoin has the classic features of a bubble. It may survive, but it is not a unit of account recognizable and usable by everyone.

Monetary economists believe a unit of account cannot survive if it is highly variable. People will not use it because it is difficult to know how much you need for settlement.

Paul Krugman describes bitcoin as a Ponzi scheme that plays almost no role in normal economic activity. But Krugman thinks all speculative bubbles are Ponzi schemes. He admits that some bubbles can go on for long periods of time. Krugman says bitcoin may achieve longevity like gold, which also lacks the attributes of a useful currency.

Joseph Stiglitz thinks bitcoin will fail after governments begin to fight back against money laundering and other fraudulent practices. Stiglitz said that in regulating abuses, the government is going to regulate bitcoin out of existence.

Eugene Fama says bitcoin should not exist. He thinks its value will drop to zero since it doesn’t have enough stability to serve as a unit of account.

Many who buy bitcoin know little about it. (Click here to learn how the protocol works). Most buy it motivated by fear of missing out (FOMO) when they see the price going up. They sell when the price falls, motivated by fear, uncertainty, and doubt (FUD). This kind of uninformed trading exacerbates price volatility.

There is also high volatility due to bitcoin’s concentration. According to the analytics firm Flipside Crypto, 2% of bitcoin addresses control 95% of bitcoin. Large holders can dramatically move bitcoin prices. They also raise concerns with the SEC about market manipulation. There is statistical evidence here of past manipulation.

Investors are becoming more educated about DeFi and crypto-assets. If bitcoin becomes more established as a portfolio diversifier and more institutions acquire it as a long-term holding, its volatility should decrease.

Fama also says bitcoin cannot serve as a store of value because that value must come from something. He says gold has the same problem, but it has other uses.

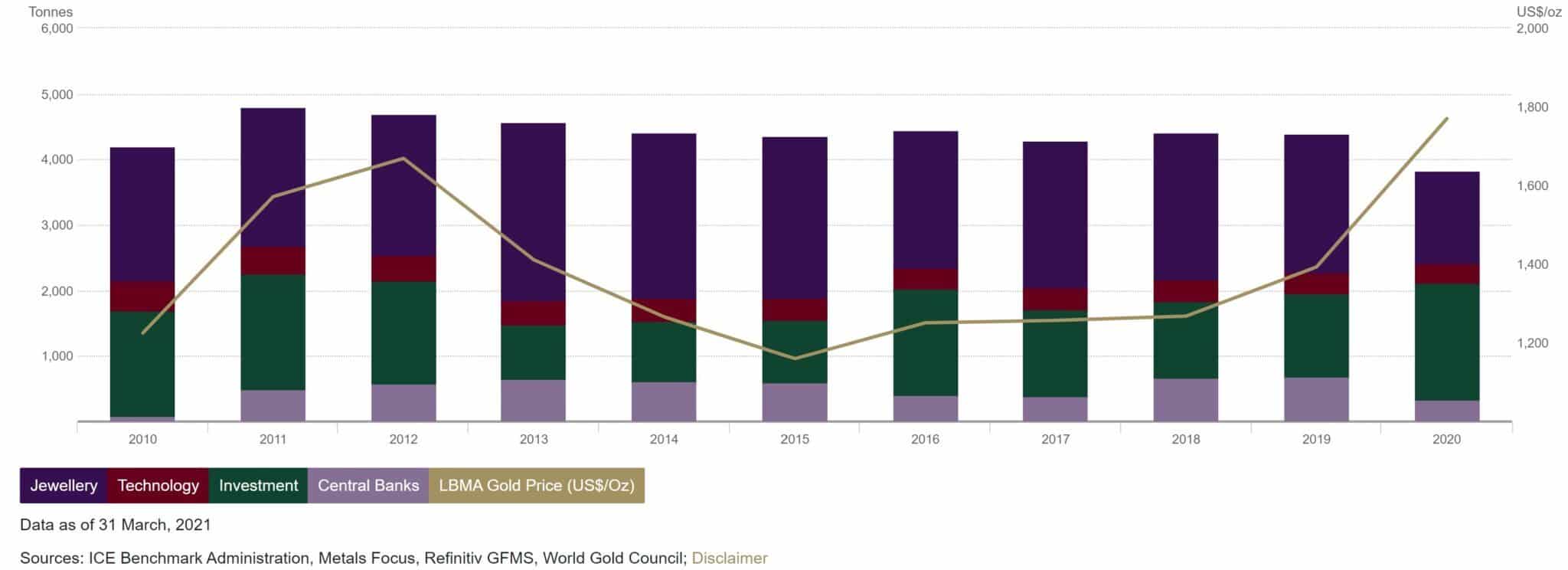

Gold Demand

Jewelry has historically been the biggest use of gold. China and India lead the world in demand for gold and gold jewelry. Jewelry is often a store of value in those countries. It is passed on from generation to generation despite its volatility.

Bitcoin also has some legitimate uses. It can allow refugees to easily transport their wealth. It can help those living in a hyperinflationary country like Venezuela or one with currency uncertainty like Nigeria. It can provide a means of funding for activists and dissidents.

Robert Merton thinks the digitization of financial services offers enormous global opportunities for improved services, lower costs, and improvements for the underserved.

Merton takes issue with bitcoin as a currency. He does not think it will ever be supported and recognized by governments. Merton says fiat currencies have intrinsic value since one can use them to settle taxes and other payments to the government. Fiat currencies must also be accepted as payment for other obligations dominated in that currency. SEC Chairman Gary Gensler, who taught blockchain technology at MIT, agrees with Merton. Gensler refuses to call digital assets “cryptocurrencies.”

Only one country, El Salvador, recognizes bitcoin as legal tender. The World Bank has refused to help them transition to it citing environmental and transparency concerns. Nine countries have banned bitcoin outright. Another nine have said bitcoin cannot be traded or used for payments.

Merton thinks governments have good reason to make bitcoin illegal due to its use by terrorists and criminals. He says its value would then plummet to zero. When asked about bitcoin’s value compared to gold, Merton said that no one has a good theory for the price of gold either.

From 1933 to 1975, it was illegal for U.S. citizens to own gold. Non-jewelry gold ownership by individuals in the 1930s was rare. Bitcoin ownership though is ubiquitous. Early this year the value of all crypto assets exceeded $2 trillion. According to a survey in January by the New York Digital Investment Group, 17% of the U.S. adult population owns bitcoin. Making bitcoin illegal now would likely create a sea of criminals.

The Coinbase exchange reported 8000 institutional crypto accounts on its books. Coinbase noted that between the end of last year and the end of the first quarter of this year, institutional crypto holdings grew 170% from $45 billion to $122 billion.

This year Fidelity Investments introduced a crypto asset data and analytics dashboard to help institutions meet the fiduciary standards necessary for investing in digital assets. Fidelity, Deutsche Bank, State Street, and BNY Mellon offer or will soon offer digital asset custodial services for institutional investors. Goldman Sachs and Morgan Stanley have also set up crypto asset trading desks.

A ban on crypto-assets in the U.S. would be unpopular and contrary to current government policies. In their strategic plan for 2020-2024, the CFTC’s stated aim was to “develop a holistic framework to promote responsible innovation in digital assets.”

Last year the Attorney General’s Cyber-Digital Task Force issued a report, Cryptocurrency: An Enforcement Framework. It highlighted the “transformative potential” of cryptos saying, “Cryptocurrencies and distributed ledger technology present tremendous promise for the future, but it is critical that these important innovations follow the law.”

National Security Risks

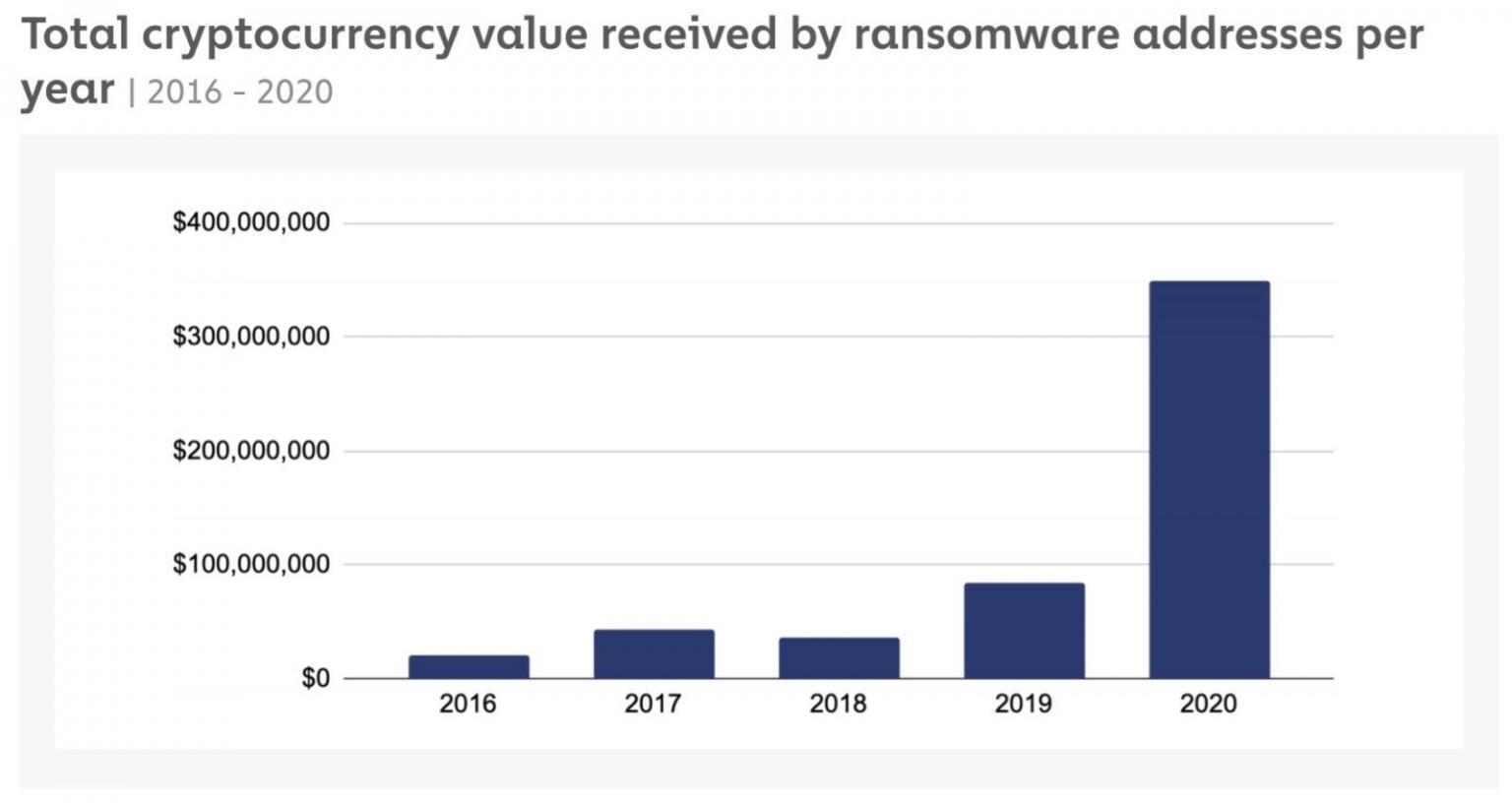

The percentage of digital transactions attributed to criminal activities is small. But there are important national security, public health, and safety threat issues that need to be considered. Treasury Secretary Yellen, formally an economics professor and Federal Reserve Chairperson, has expressed concern about bitcoin’s use by terrorists and criminals. She said, “We really need to examine ways in which we can curtail their use and make sure money laundering doesn’t occur through those channels.”

Secretary of Energy Granholm said our enemies are now capable of shutting down the power grid. She stated, “There are thousands of attacks on all aspects of the energy sector and the private sector generally… it’s happening all the time.”

Ransomware demands have become rampant. Attorney General Merrick Garland told Congress that cyber-extortion is a “very, very serious threat that is getting worse.” In 2020, there were 2474 ransomware cases reported to the FBI. This was a 66% increase from the prior year. An estimated $350 million was paid in 2020 to hackers. This was 311% more than in 2019. Many cases go unreported because businesses do not want negative publicity.

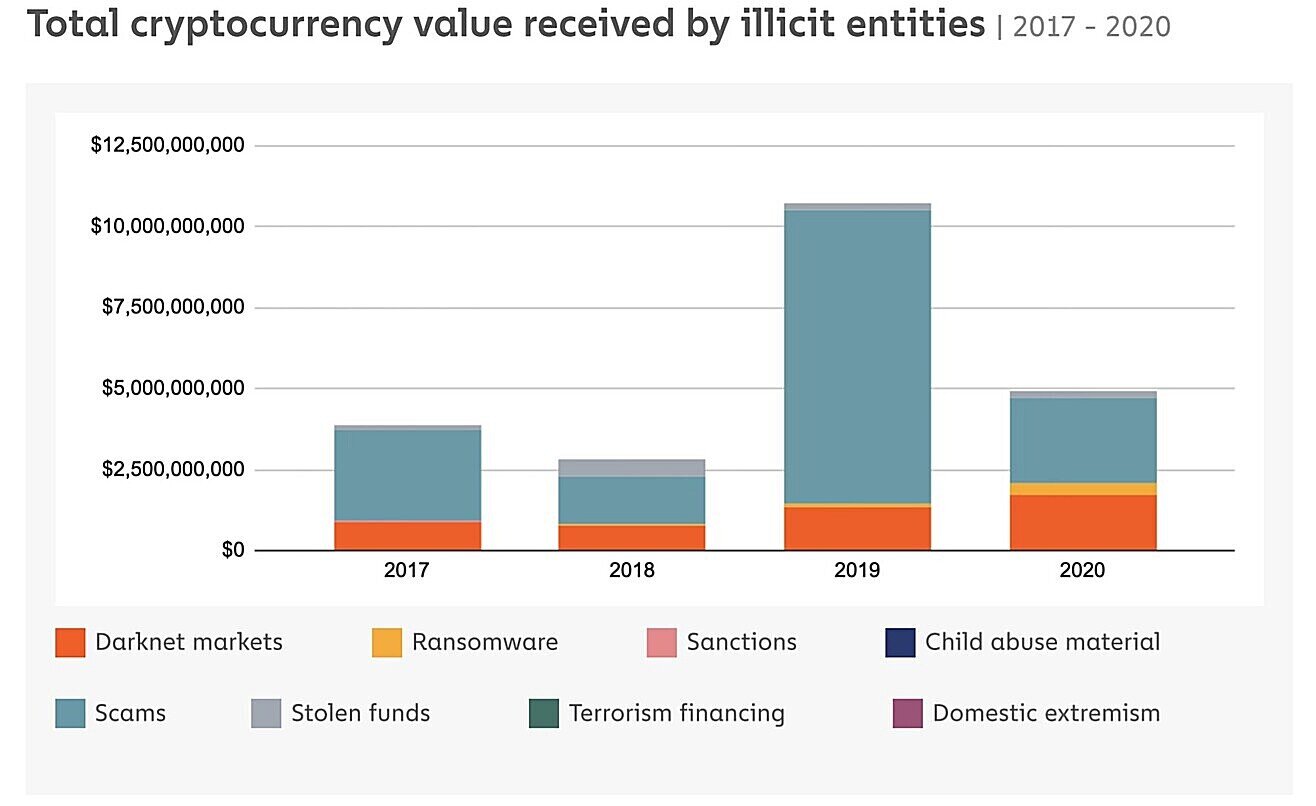

Source: Chainanalysis 2021 Crypto Crime Report

The Colonial Pipeline attack that shut down energy supplies to the East Coast brought public attention to how ransomware can threaten our infrastructure and national security.

After the Colonial Pipeline attack, JSA meat packing paid an $11 million ransom. Brett Callow, a threat analyst with Emisoft, says the JSA ransom was paid using Monero, a privacy coin that is much harder to track than bitcoin. Crypto compliance expert Justin Ehrenhofer estimates that 10 to 20% of ransoms last year were paid using Monero. He expects that to rise to 50% by the end of this year. This will make tracking and recovering ransoms even harder.

So far, the only recovery of ransom monies has been $2.3 million of the $4.4 million paid in bitcoin by Colonial. As bad as ransomware is, scams and darknet illicit activities overshadow it.

Source: Chainanalysis 2021 Crypto Crime Report

Crypto exchange hacks are also rampant. The founders of Africrypt, one of South Africa’s most popular exchanges, ran off with $3.6 billion of customer assets.

Experts say that even with the best defensive technology, hackers could find ways to get through it given enough time and resources. Making ransom payments illegal, which Secretary Granholm has suggested, is not a good solution. Companies in danger of going out of business may pay ransoms in secret. Hackers could step up their targeting of critical enterprises least likely to be able to deal with downtime. This might impact hospitals, power grids, water treatment plants, energy providers, and airports.

Technology Risk

Some smaller digital coins have come under a 51% or minority attack. This is when blockchain is attacked by a group of miners who control more than 50% of a coin’s computing power. This would give them a mining monopoly and let them earn all the mining rewards. They could also double-spend coins creating counterfeit trades. This would seriously erode confidence in that asset.

Right now, bitcoin is in no danger of a 51% attack. But quantum computing is coming. It will lead to dramatically increased computing power and make the bitcoin network vulnerable to these kinds of attacks.

Other systems dependent on cryptography may also be targets of 51% attacks. There are some already working on defensive solutions to this problem. No one knows when they will be found or when quantum computing will become a reality.

Climate Change

Elon Musk said Tesla would no longer accept bitcoin in payment for its cars. He cited concerns over the “rapidly increasing use of fossil fuels for bitcoin mining and transactions.”

Mining difficulty has been increasing over the past three years requiring ever greater expenditures on electricity. Treasury Secretary Yellen said of bitcoin, “It’s an extremely inefficient way of conducting transactions, and the amount of energy that’s consumed in processing those transactions is staggering.” With the energy from processing one bitcoin, VISA can process 800K transactions.

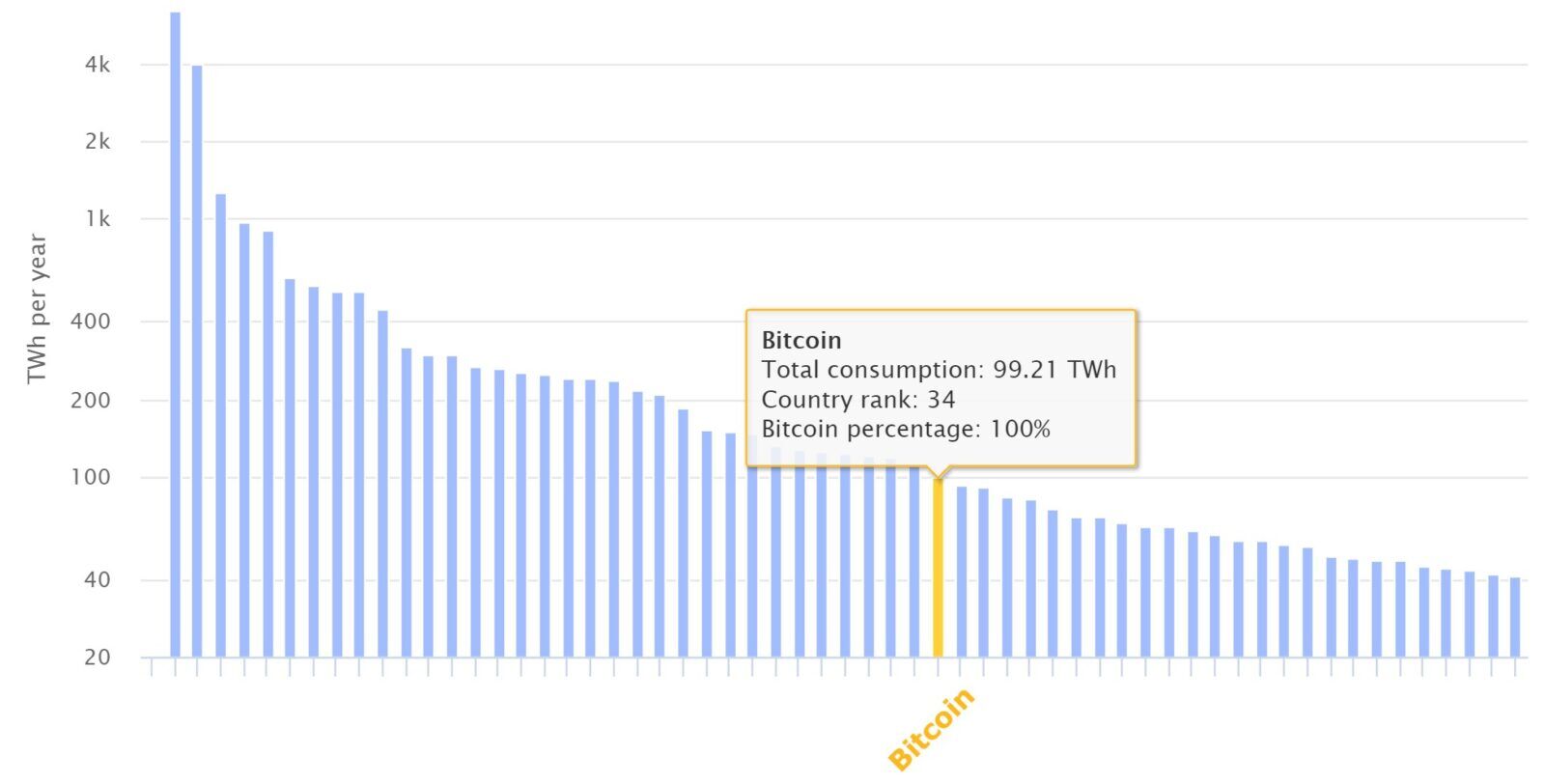

The Cambridge Bitcoin Electricity Consumption Index of annual bitcoin energy consumption is around 100 TWh per year. This is like the electricity consumption of the Netherlands or the Philippines. Bitcoin would be ranked 34th compared to the energy consumption of nation-states.

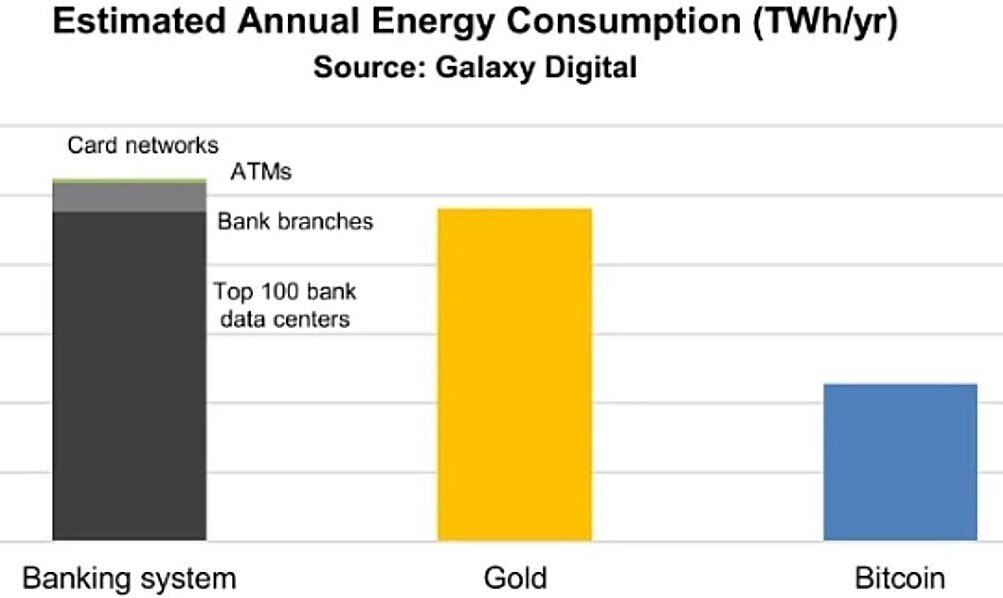

The crypto industry has tried to counter attacks on its high electricity usage by pointing to the energy used in gold production and banking.

But gold has other uses, and its market cap is ten times more than bitcoin’s market cap. Some also say gold is a “barbarous relic,” and two wrongs do not make a right.

The banking system is a sunken cost and is here to stay regardless of what happens with bitcoin. Banks serve an important function as regulated lenders and a way to evaluate entrepreneurial projects.

Bitcoin is best evaluated on its own as to whether its benefits justify its externality costs. With increasing ESG sensitivity among investors, especially institutional ones, the digital asset industry is making efforts toward greater sustainability. The Bitcoin Mining Council was recently set up to promote energy usage transparency and to speed up sustainability initiatives. Members will publish current and planned renewables usage.

Blockstream and Square have agreed to build an open-source, proof-of-concept solar-powered mining facility. Crusoe Energy will be using excess natural gas from energy operations to mine bitcoin and reduce gas flares. El Salvador plans to use its geothermal volcanic energy to mine bitcoin.

The Bitcoin Clean Energy Initiative speculates that the bitcoin network might actually encourage more renewable energy production. When used as a flexible load option, miners could help solve intermittency and congestion problems allowing energy grids to deploy more renewable energy.

The digital asset industry has a ways to go in reversing its increasing use of fossil fuels. But they are making some effort in that direction. Elon Musk recently tweeted, “When there’s confirmation of reasonable (~50%) clean energy usage by miners with a positive future trend, Tesla will resume allowing Bitcoin transactions.”

Chinese Solution

China is often more forward-looking and has more control over its economy than other countries. They took the lead in developing solar technology, 5G, EVs, driverless cars, and facial recognition software.

China began addressing digital asset issues in 2013 when it banned financial institutions from handling bitcoin transactions. In 2017, China closed local crypto exchanges and outlawed initial coin offerings (ICOs). More recently, China came up with rules prohibiting financial institutions from providing services related to digital assets. These changes greatly reduce the possibility of ransomware attacks and payments for other illicit activities.

China has long been home to more than half the world’s bitcoin miners. Last month the Chinese government called for a severe crackdown on bitcoin mining due to environmental concerns. Most of China’s mining activity has come from four provinces. Three of these provinces have now banned bitcoin mining. More than 90% of China’s bitcoin mining has been shut down.

China recently became the first major nation to adopt a digital version of its currency. The CBDC Tracker Research Group reported more than 60 countries (including the U.S.) at some stage of studying or developing their own CBDC. Central Bank Digital Currency (CBDC) may be able to replace the function that bitcoin serves in developing countries lacking infrastructure.

China’s actions are in alignment with the majority views of Nobel laureate economists who are positive on blockchain technology and in favor of governmental rather than private digital assets.

Possible U.S. Action

Ray Dalio thinks bitcoin’s greatest risk could be its success. He says the government is likely to crack down on bitcoin if substantial funds start going into it instead of into government bonds.

No central bank wants to give up its monopoly on money. The U.S. has the most to lose since the U.S. dollar is the world’s reserve currency. As long the U.S. maintains its reserve currency status, it can export inflation to the rest of the world and bring in relatively cheap imports for the benefit of U.S. consumers.

It is unlikely we will see an outright ban on digital assets in the U.S. for the reasons given above. But there is precedent for putting restrictions on financial transactions to curb illegal activity.

Offshore sportsbooks accepting wagers from U.S. customers have always been illegal. The U.S. government has been unable to enforce this overseas. So, in 2006 Congress passed the Unlawful Internet Gambling Enforcement Act (UIGEA). This made it illegal for U.S. financial institutions to make transfers to unlawful Internet gambling sites. Now, U.S. bettors usually use bitcoin to fund their offshore accounts.

Congress could pass a similar law making it illegal for financial institutions to transfer funds to and from crypto exchanges. This could put an end to ransomware attacks since companies would no longer be able to legally deliver bitcoin or other digital assets. It would also reduce illegal money laundering activities.

Those in the U.S. could still own or trade digital assets. But they would no longer be able to receive or deliver them on a cash basis. They could own digital assets using bonafide funds, institutional custodians, or registered broker-dealers who would be required to maintain custody of those assets.

What I Do Now

To pick the winner of the Academy Award’s Best Picture award, you should not necessarily select the one you think is best. You should pick the one that you believe the judges will think is best. It is the same with Bitcoin. You need to assess market sentiment, then invest accordingly.

One way to discern sentiment is to look at price trends. I use a simple trend-following model now to trade bitcoin and provide these bitcoin signals to my proprietary model investors.

With bitcoin’s usable price history going back only ten years, I chose a model that had a history of working well in unrelated markets. Here are the results of this model applied to daily data.

| Bitcoin Upward Bound Long Entries (BUBLE) | ||||

| Buy Date | Buy Price | Sell Date | Sell Price | % Return |

| 12/20/11 | 4.75 | 01/31/12 | 5.70 | 20.0 |

| 03/14/12 | 5.44 | 03/20/12 | 4.82 | -11.4 |

| 04/20/12 | 5.15 | 10/22/12 | 11.54 | 124.1 |

| 11/17/12 | 11.48 | 06/09/13 | 109.11 | 850.4 |

| 07/31/13 | 96.98 | 12/17/13 | 690.50 | 612.0 |

| 01/05/14 | 828.79 | 02/10/14 | 713.00 | -14.0 |

| 04/16/14 | 523.10 | 04/28/14 | 430.00 | -17.8 |

| 05/22/14 | 494.00 | 06/14/14 | 592.00 | 19.8 |

| 07/01/14 | 640.00 | 07/26/14 | 602.93 | -5.8 |

| 11/12/14 | 370.09 | 12/11/14 | 345.22 | -6.7 |

| 02/15/15 | 256.81 | 03/19/15 | 256.59 | -0.1 |

| 05/09/15 | 243.22 | 06/01/15 | 228.91 | -5.9 |

| 06/16/15 | 236.00 | 08/13/15 | 267.53 | 13.4 |

| 09/29/15 | 239.14 | 01/16/16 | 360.62 | 50.8 |

| 02/15/16 | 405.50 | 05/22/16 | 442.72 | 9.2 |

| 05/28/16 | 470.58 | 08/01/16 | 622.50 | 32.3 |

| 09/04/16 | 596.25 | 01/12/17 | 778.70 | 30.6 |

| 02/01/17 | 964.00 | 03/18/17 | 1068.16 | 10.8 |

| 04/04/17 | 1146.42 | 07/11/17 | 2323.45 | 102.7 |

| 07/31/17 | 2745.76 | 09/14/17 | 3861.89 | 40.6 |

| 10/01/17 | 4326.09 | 01/17/18 | 11394.00 | 163.4 |

| 02/18/18 | 11101.00 | 03/09/18 | 9293.06 | -16.3 |

| 04/16/18 | 8353.43 | 05/12/18 | 8408.79 | 0.7 |

| 07/18/18 | 7310.71 | 08/05/18 | 7010.00 | -4.1 |

| 09/01/18 | 7015.78 | 09/08/18 | 6401.00 | -8.8 |

| 12/24/18 | 3947.82 | 01/20/19 | 3680.00 | -6.8 |

| 02/17/19 | 3580.43 | 07/17/19 | 9427.45 | 163.3 |

| 08/05/19 | 10986.55 | 08/15/19 | 10022.50 | -8.8 |

| 10/26/19 | 8677.09 | 11/11/19 | 8499.53 | -2.0 |

| 01/07/20 | 7768.17 | 02/27/20 | 8778.37 | 13.0 |

| 04/07/20 | 7335.85 | 09/04/20 | 10160.00 | 38.5 |

| 10/10/20 | 11060.46 | 04/22/21 | 53823.48 | 386.6 |

| Average Return | 75.6% | |||

| Win Percent | 58.8% | |||

Bitcoin is extremely volatile. Trading bitcoin is very high risk. Results are not a guarantee of future success and do not represent returns that any investor attained. Performance does not represent actual bitcoin performance. CAGR is the compound annual growth rate. Max drawdown is the worst cumulative trade-to-trade loss plus any unrealized loss on the next open position. Data is from Bitstamp. Please see the Disclaimer at the end of this document for more information.

As a robustness test, I applied the same model to Ethereum. Those returns were also good compared to buy-and-hold. Ethereum has more uses and has been performing better than bitcoin.

I was also successful in applying this model to non-crypto markets.

Implementation

An easy way to trade bitcoin is by using one of the popular apps by Coinbase, Robinhood, Square, SOFI, or PayPal. Since these apps are directed toward small speculators, transaction costs are generally high.

Another way to trade bitcoin is through an established crypto exchange. There are eight set up to do business in the U.S.: Coinbase Pro, Kraken, Binance US, FTX US, Bitstamp, Bittrex, Poloneix US, Bitflyer USA, and Gemini. Coinbase Pro has the most liquidity, but its transaction costs for U.S. traders are high unless you trade very large positions. Coinbase has also had customer service issues in the past.

Interactive Brokers announced they will offer low-cost crypto trading to their brokerage clients by the end of the summer. Webull is another brokerage option for retail investors.

Another way to trade bitcoin is with futures contracts. Since bitcoin is a 1256 asset, gains and losses will be 60% long-term and 40% short-term regardless of the holding period. You will also need to pay taxes on any unrealized gains at year-end. Futures are a regulated market that can provide more customer protection than the unregulated cash market. There is a U.S.-based mutual fund called the Bitcoin Strategy Profund (BTCFX) that holds bitcoin futures.

Many want to own bitcoin through an ETF. There are nine bitcoin ETFs available in Europe and four in Canada. None have been approved in the U.S. so far. SEC Chairman Gensler has said the crypto sector could benefit from greater investor protections. He also urged Congress to give the SEC authority over all digital asset trading.

For now, in the U.S. we have two publicly traded bitcoin investment trusts. The largest is Grayscale Bitcoin Trust (GBTC). It has a 2% expense ratio and trades at a premium or discount to NAV that has ranged from +35% to -21%.

The smaller Osprey Bitcoin Trust (OBTC) has a 0.40% expense ratio and sells at a 20% premium to NAV. You can buy shares directly from Osprey at NAV if you are an accredited investor and have at least $25 k to invest. Both these trusts could go to a big discount to NAV if a U.S.-based ETF is ever approved. ETFs are more desirable than investment trusts since ETFs always trade at or near their NAVs. They also often have more liquidity and lower expense ratios. ETFs holding bitcoin futures should be able to pass through the favorable 1256 tax treatment of futures.

Until the U.S. has a bitcoin ETF, U.S. investors can buy Canadian ones. Fidelity lets its U.S. customers do this.

Bitcoin and Gold

Some refer to bitcoin as digital gold. There are some similarities. Both are scarce and fungible. Both have price movements determined more by speculative demand than by inherent economic value.

But there are also some differences. Bitcoin is more portable, divisible, and accessible than gold. But gold has passed the test of time. It has been a store of value for thousands of years. Gold is also a physically tangible asset. Gold and collectibles maintain their value not only because of their scarcity but because of their beauty or of one’s pride in owning them. It is hard to make that case for bitcoin.

Academic research shows that gold and bitcoin have fundamentally different properties. Gold has flight-to-quality and hedging capabilities in times of market distress. Bitcoin does not. It may even perform oppositely.

Conclusion

Based on speculative demand, the price of bitcoin may still appreciate considerably. Bitcoin has had enormous drawdowns but has so far always rebounded to new highs. This resiliency is what makes bitcoin different from the usual bubble asset.

But bitcoin could still permanently lose most of its value. In the future, there may be lower-cost alternatives. This year the average transaction fee for sending bitcoin has ranged from around $8 to over $60. Alternatives to bitcoin might also have more transparency and less environmental impact.

Wampum

DISCLAIMER

Future performance may differ significantly from historical performance. Hypothetical performance results are presented for illustrative purposes only and should not be interpreted as an indication of future performance or as investment advice. Digital assets involve substantial risks that you should investigate carefully.

Hypothetical performance results (e.g., quantitative backtests) have many inherent limitations, some of which, but not all, are described herein. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses can adversely affect actual trading results.

The hypothetical performance results contained herein represent the application of the quantitative model as currently in effect, and there can be no assurance that the model will remain the same in the future or that an application of the current model in the future will produce similar results because the relevant market and economic conditions that prevailed during the hypothetical performance period will not necessarily recur.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program that cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results.