Bitcoin (BTC) is becoming more and more mainstream. Over 50 million in the U.S. now own it. After a long wait for regulatory approval, there are ten U.S. spot Bitcoin ETFs. After one month of trading, they have attracted over $4 billion in new investment capital. Seventy-seven percent of advisors say they will buy Bitcoin ETFs for their clients. Bitcoin ETFs are still making their way onto investment platforms.

Thousands of businesses and tens of thousands of ATMs now accept Bitcoin. Bitcoin has appeal as a safe harbor. It is a store of value like gold. Also, like gold, Bitcoin is scarce and fungible. Bitcoin is more portable, divisible, and accessible than gold. ETFs have eliminated the security risks that were once associated with cryptocurrencies.

The purchasing power of fiat currencies erodes over time as the money supply created by central banks keeps increasing. But Bitcoin has a limited supply which makes it resistant to monetary inflation.

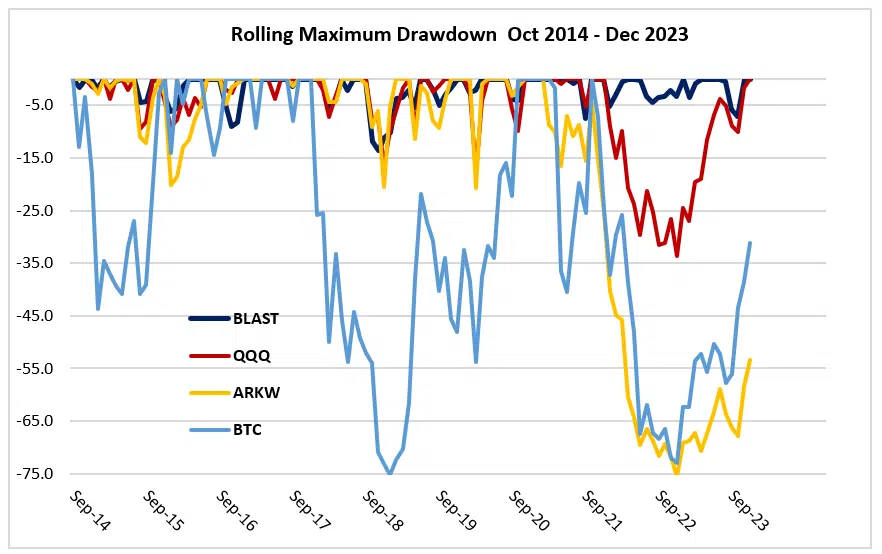

There are some drawbacks however to Bitcoin. Stocks and bonds can attract capital when they reach very low valuations because they have intrinsic value. But Bitcoin is based on speculative rather than intrinsic value. This increases its volatility and makes it vulnerable to precipitous price drops.

It is also challenging for Bitcoin to be a store of value when it is subject to 75% drawdowns every few years. This can limit the size of Bitcoin holdings for most investors and reduce its potential for having a meaningful impact on one’s portfolio.

I dealt with these issues in 2017 by investing in Bitcoin and other cryptocurrencies using a dual momentum model. This limited my downside exposure. In 2020, I bought Bitcoin when it was cheap and then managed it with a trend-based model after it had appreciated. More recently I checked out Bitcoin as part of a robustness test for an exceptional trend-based model I developed for trading gold. The Bitcoin results were better than the results of any other asset.

However, there were still some issues with trading Bitcoin. First, Bitcoin is a 24/7 market. This makes trading spot Bitcoin challenging. No one wants to wake up at 3 AM to trade. It is also difficult to construct optimal portfolios matching Bitcoin’s daily results, including weekends, with the five-day results of other markets.

Bitcoin futures-based ETFs have made this easier. However, these are recent investment vehicles. There is not enough data yet to feel confident about backtested results.

Blockchain Investing

I began looking for equity ETFs that track Bitcoin and the crypto industry well but with less volatility. I found six liquid ones: ARK Next Generation Internet (ARKW). Amplify Transformational Data Sharing (BLOK), Bitwise Crypto Industry Innovators (BITQ), Global X Blockchain (BKCH), Fidelity Crypto Industry & Digital Payments (FDIG), and VanEck Digital Transformation (DAPP).

ARKW and BLOK have the longest trading history and the highest trading volume. They invest in companies having blockchain operations and technology or are committed to the technologies’ advancement. Both track Bitcoin reasonably well and are a gentler way than Bitcoin to take part in the blockchain revolution.

BLAST MODEL

BLOK has had a 0.81 daily correlation with Bitcoin futures ETFs since they started trading in late 2021. BLOK tracks Bitcoin better than ARKW, but ARKW has 50% more trade history. So, we use ARKW as the basis of our Blockchain Algorithmic System Trading (BLAST) model until BLOK begins trading. Then BLAST switches to BLOK.

BLAST is in BLOK or ARKW around 48% of the time. BLAST averages two trend trades and one short-term mean reversion trade per year.

Like most of our proprietary models, BLAST holds the same positions as our Advanced Global Equities (A-GEM) model when it is not invested in BLOK. [2]

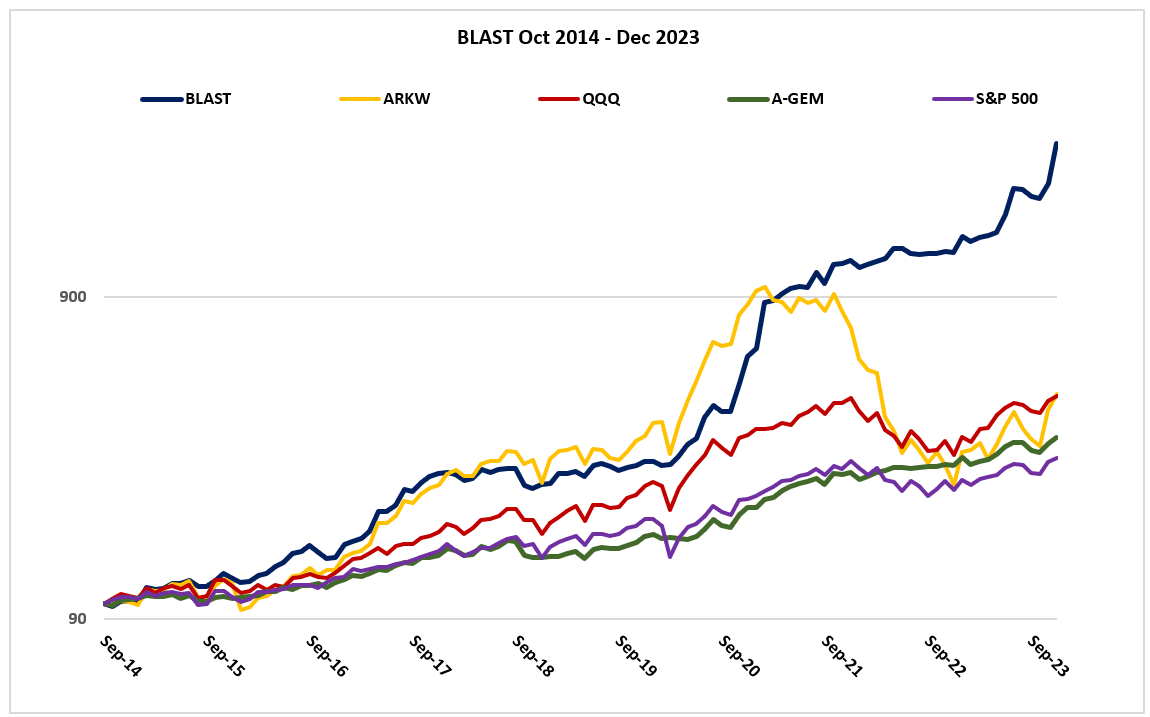

Here are the results from when ARKW began trading in October 2014:

QQQ | S&P500 | ARKW | AGEM | BTC | BLAST | |

CAGR | 17.3 | 11.9 | 17.5 | 13.6 | 65.3 | 42.4 |

STD DEV | 20.3 | 16.6 | 34.1 | 10.5 | 75.9 | 25.3 |

SHARPE | 0.9 | 0.77 | 0.65 | 1.28 | 1.03 | 1.54 |

UPI | 1.98 | 1.96 | 0.81 | 4.23 | 2.97 | 13.73 |

MAX DD | -33.7 | -23.8 | -75.7 | -11.8 | -75.2 | -13.6 |

AVG DD | -5.5 | -3.9 | -16.8 | -1.9 | -29.8 | -1.8 |

W% MOS | 66 | 68 | 63 | 67 | 56 | 71 |

Results do not guarantee future success nor represent returns that any investor attained. Performance includes reinvestment of interest and dividends. CAGR is the compound annual growth rate. Maximum drawdown is on a cumulative month-end basis. UPI is the Ulcer Performance Index. It is like the Sharpe Ratio but divides average return by the Ulcer Index rather than the standard deviation. The Ulcer Index measures the depth and duration of drawdowns from earlier highs. See our Disclaimer page for more information.

Those who want to should be able to come up with similar trend-following models for managing blockchain or other investments.

Blockchain Logic

There is little reason to bear the high risks of Bitcoin when BLAST can use blockchain companies to create exceptional trading profits with much less volatility.

Insightful investors see past the nature of their assets. Commodities traders might hold obscure futures like frozen concentrated orange juice or pork bellies. They might not be enamored with these. But they can still profit from them when their trends are strong. Blockchain technology offers the same opportunity. It also makes more sense than OJ and bacon as long-term investments.

Please contact us for more information on BLAST.