Whither Fragility? Dual Momentum GEM

Corey Hoffstein of Newfound Research recently wrote an article called, “Fragility Case Study: Dual Momentum GEM.” Corey starts out by saying my dual momentum approach is the strategy he sees implemented the most among do-it-yourself tactical investors. Corey then said several investors bemoaned that GEM kept them invested in the stock market during the last […]

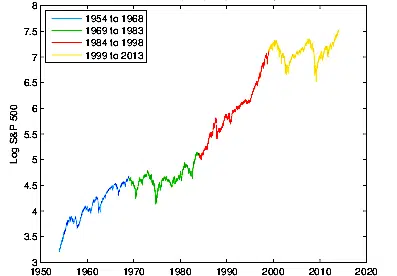

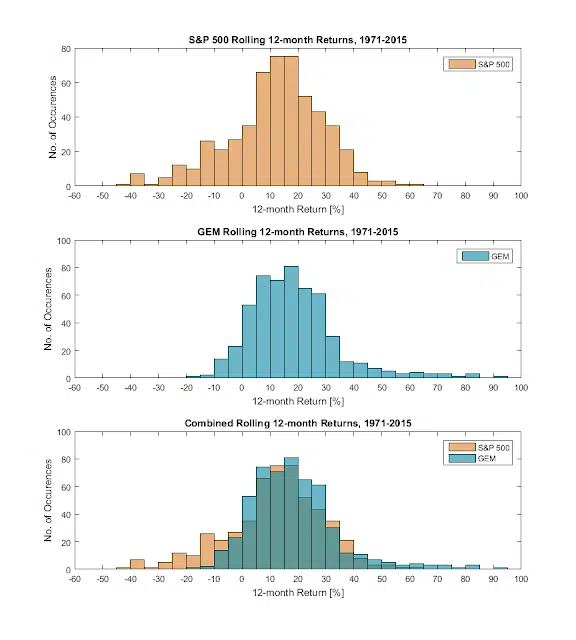

Extended Backtest of Global Equities Momentum

In 2013, I created my Global Equities Momentum (GEM) model. It holds U.S. or non-U.S. stock indices when stocks are strong and uses bonds as a safe harbor when stocks are weak.When my book, Dual Momentum Investing, was published in 2014, I had Barclays bond index data back to 1973. Since one year of data is […]

Perils of Data Mining

From the time my book was published others have tried to improve upon the book’s Global Equity Momentum (GEM) model. There is nothing wrong with trying to improve on someone’s work. That is how progress is made. But if not careful, such attempts can have data mining, overfitting, and selection bias issues. Data mining is […]

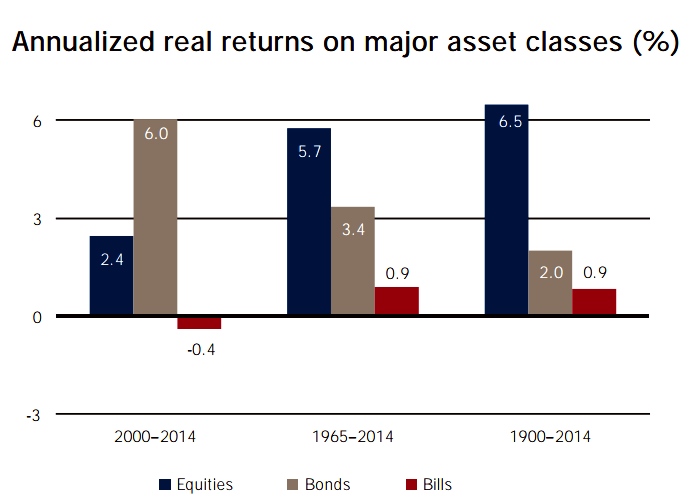

Momentum Solutions for Retirement

by Matthew Richardson, JD, Ph.D. As the surge of boomer retirements continues, commentators have given new thought to what safe withdrawal rates are for retirement accounts. The topic is especially significant given two additional factors. First, retirement balances are shockingly low for boomers (Ghilarducci 2015)[1]. Second, market fundamentals do not suggest that either bonds or […]

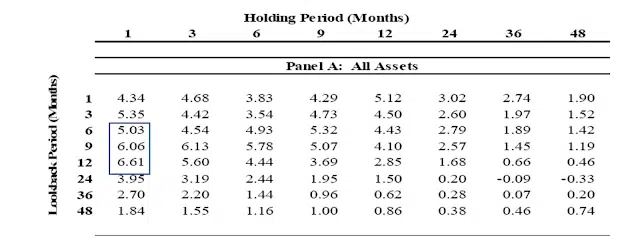

Common Misconceptions About Momentum

Momentum is one of the most researched topics in financial market literature. A search of the SSRN database on momentum will turn up 1000 papers written over the past three years and 3000 papers in total. With so much information available, it is not surprising that many analysts have missed seeing some of the research. Their […]

Factor Zoo or Unicorn Ranch?

According to Morningstar, as of June 2016, the assets in smart beta exchange-traded products totaled $490 billion. BlackRock forecasts smart beta investing using size, value, quality, momentum, and low-volatility factors will reach $1 trillion by 2020 and $2.4 trillion by 2025. This annual growth rate of 19% is double the growth rate of the entire […]

Mistakes of Momentum Investors

Like most investors, those using momentum are often guilty of chasing performance. In fact, momentum requires that we do this. But it should be done in a disciplined and systematic way. Performance chasing should not be due to myopia, irrational loss aversion, or other psychological biases. Behavioral Challenges It is not always easy adhering to a disciplined […]

Book Review of Quantitative Momentum

I have been looking forward to Jack and Wes’s new book. It is the only book besides my Dual Momentum Investing that relies on academic research to develop systematic momentum strategies. My book uses a macro approach of applying momentum to indices and asset classes. Wes and Jack (W&J) take the more common approach of applying momentum […]

Book Review: Standard Deviations, Flawed Assumptions, Tortured Data and Other Ways to Lie with Statistics

Years ago, when asked to recommend some good investment books, I often suggested ones dealing with the psychological issues influencing investor behavior. These focused on investor fear and greed, showing “what fools these mortals be.” Here are examples: Devil Take the Hindmost: A History of Financial Speculation by Edward Chancellor, and Extraordinary Popular Delusions and the Madness of […]

Why Does Dual Momentum Outperform?

Those who have read my momentum research papers, book, and this blog should know that simple dual momentum has handily outperformed buy-and-hold. The following chart shows the 10-year rolling excess return of our popular Global Equities Momentum (GEM) dual momentum model compared to a 70/30 S&P 500/U.S. bond benchmark [1]. Results are hypothetical, are NOT […]