Results are hypothetical, are NOT an indicator of future results, and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Please see our Performance and Disclaimer pages for more information.

GEM has outperformed its benchmark over the long run, although the amount of outperformance has varied over time. In 1984 and 1997-2000, those who might have guessed that dual momentum had lost its mojo saw its dominance come roaring right back.

In Chapter 4 of my book, I give some explanations of why momentum has worked well. The reasons fall into two general categories: rational and behavioral. In the rational camp are those who believe that momentum earns higher returns because its risks are greater. That argument is harder to justify now that absolute momentum has shown the ability to provide higher returns and reduced risk exposure.

The behavioral explanation for momentum centers on initial investor underreaction of prices to new information. This is followed later by overreaction. Underreaction comes from anchoring, conservatism, and the slow diffusion of information. Overreaction is due to herding (the bandwagon effect), representativeness (assuming continuation of the present), and overconfidence. Price gains attract more buying which leads to further price gains. The same is true with losses and continued selling.

The herding instinct is one of the strongest forces in nature. It is what allows animals in nature to better survive predator attacks. It is a powerful primordial instinct built into our brain chemistry and DNA. It is therefore unlikely to disappear. Representativeness and overconfidence are also evident when there are strong momentum-based trends.

Furthermore, investors’ loss aversion may decrease as they see prices rise and they become overconfident. Their loss aversion may similarly increase as prices fall and they become more fearful. Studies have shown that investors are about 2 times more likely to avoid losses than they are willing to seek gains. These natural psychological responses are also unlikely to change in the future.

One can make a sound logical argument for the investor overreaction explanation of the momentum effect with individual stocks. Stocks can have high idiosyncratic volatility and be influenced by news events, such as earnings surprises, management changes, plant shutdowns, employee strikes, product recalls, supply chain disruptions, regulatory constraints, and litigation.

A recent study by Heidari (2015) called “Over or Under? Momentum, Idiosyncratic Volatility and Overreaction” looked into investors under or overreaction with stocks and found evidence that supported the overreaction explanation as the source of momentum profits, especially when idiosyncratic volatility was high.

Many economic trends, not just stock prices, get overextended and then mean revert. The business cycle trends and mean reverts. Since the late 1980s, researchers have known that stock prices are long-term mean-reverting [2]. Mean reversion supports the premise that stocks overreact and become overextended, which leads to their mean reversion. We can make a case that overreaction in both bull and bear market environments provides a good explanation for why dual momentum has worked so well compared to buy-and-hold.

Dual Momentum Performance

Results are hypothetical, are NOT an indicator of future results, and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Please see our Performance and Disclaimer pages for more information.

Relative momentum provided almost 300 basis points more annual average return than the underlying S&P 500 and MSCI ACWI ex-US indices. It did this by capturing profits from both indices rather than just from a single one. We can tell from the above chart that some of these profits came from price overreaction since both indices pulled back sharply following their strong run-ups. Relative momentum profits, in this case, are also aided by neglect as investors fail to capture more profit from non-U.S. stocks due to strong home country bias.

Even though relative momentum gives us substantially increased profits, it does nothing to alleviate downside risk. Relative momentum volatility and maximum drawdown are comparable to the underlying indices themselves.

We see in the above chart that absolute momentum applied to the S&P 500 created almost the same terminal wealth as relative momentum, and it did so with much less drawdown. Absolute momentum accomplished this by sidestepping the severe downside bear market overreactions in stocks. As with relative momentum, there is ample evidence of price overreaction, since there were sharp rebounds from oversold levels following most bear market lows.

We see that overreaction comes into play twice with dual momentum. First, is when we exploit positive overreaction to earn higher profits from the strongest market selected by relative momentum. Trend following absolute momentum can help lock in these overreaction profits before the markets can mean revert.

The second way overreaction comes into play is when we avoid it by standing aside from stocks when absolute momentum identifies the trend of the market as being down. Based on this synergistic capturing of overreaction profits while avoiding overreaction losses, dual momentum produced twice the incremental return of relative momentum alone. And it did this while maintaining the same stability as absolute momentum. We should keep in mind that stock market overreaction, as the driving force behind dual momentum, is not likely to disappear.

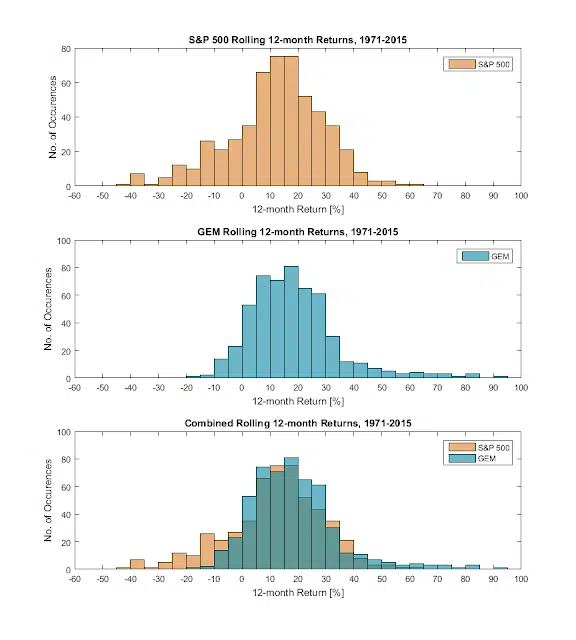

Distribution of Returns

Looking at things a little differently, the following histogram shows the distribution of 12-month returns of GEM versus the S&P 500. We see that GEM has participated well in bull market upside gains while truncating left tail risk representing bear market losses. Dual momentum, in effect, converted market overreaction losses into profits.

Results are hypothetical, are NOT an indicator of future results, and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Please see our Performance and Disclaimer pages for more information.

During bull markets, GEM produced an average return somewhat higher than the S&P 500. This meant that relative momentum earned more than absolute momentum gave up on those occasions when absolute momentum exited stocks and had to reenter stocks a month or several months later [3]. Relative momentum also overcame lost profits when trend-following absolute momentum kept GEM out of stocks as new bull markets were just getting started. With only absolute momentum, the bull market average return would have been 214.9% instead of the 289.9% return that came from using both relative and absolute momentum.

What really stands out though are the average profits that GEM earned in bear market environments when stocks lost an average of 37%. Without only relative momentum, the bear market average return would have been -33.1% instead of the 3.6% positive return that came form using both relative and absolute momentum. Absolute momentum, by sidestepping bear market losses, is what accounted for much of GEM’s outperformance.

Large losses need much larger gains to recover from those losses. For example, a 50% loss requires a 100% gain to get back to breakeven. By avoiding large losses in the first place, GEM has not been saddled with this kind of loss recovery burden. Warren Buffett was right when he said that the first (and second) rule of investing is to avoid losses.

But increased profits through relative strength and loss avoidance through absolute momentum are only half the story. Avoiding losses also contribute to our peace of mind. It helps prevent us from becoming irrationally exuberant or uncomfortably depressed, which can lead to poor timing decisions. Not only does dual momentum help capture overreaction bull market profits and reduce overreaction bear market losses, but it gives us a disciplined framework to keep us from overreacting to the wild vagaries of the market.

[1] GEM has been in stocks 70% of the time and in aggregate or government/credit bonds around 30% of the time since January 1971. See the Performance page of our website for more information.

[2] See Poterba and Summers (1988) or Fama and French (1988).

[3] Since January 1971, there have been 10 instances of absolute momentum causing GEM to exit stocks and reenter them within the next 3 months, foregoing an average 3.1% difference in return.